I don’t know a single person who wouldn’t want to travel more than they do right now. I know that I would love to travel 3+ months out of the year, and maybe one day that will be a reality for me. However, I still have to work full time to pay bills: mortgage, student loans, credit cards, and regular expenses. Just because I have those time constrains and obligations doesn’t mean I’m not looking to save for travel.

Currently, I’m content to travel as much as my office vacation policy allows (around 15 days). In order to do that, along with meet all my other financial obligations, I have to do some planning. The best way to do that is with a budget!

There are tons of other ways make more money to add to that travel fund, but I firmly believe that the starting point should always be a good handle of what your current situation allows. Starting with a budget, allows to you have a better idea of what is truly needed to reach your goals. It also helps you define those goals! Win-win!

Create a Budget

You will never know what you are capable of if you don’t know where you are starting from.

Budgeting can be a very scary thing. It’s daunting to sit down and review debts and spending habits, especially if you have a sizable debt balance. Maybe you went on a big shopping spree, splurged on a fantastic vacation, have an enormous amount of student loans (I do!!), or had something tragic happen that resulted in large amounts of debt. But on the other hand, you might discover that the picture isn’t as bleak as you might think.

So, grab a glass of wine, sit down and assess the damage.

There are tons of apps that can help you set up your budget. Quicken is one I used for a long time when I was single. When my husband, Travis, and I got married and combined our finances, I needed something much more user friendly. He was not used to budgeting more than a month out.

I probably downloaded 15+ money management apps to try to find one that was user friendly enough to get Travis on board. He was very resistant to anything that took to long or was too many steps. Of those 15 that I tried, I only had him try 2. All the others either didn’t do enough for the financial manager in me and/or were too complicated for Travis.

Ultimately, YNAB won the contest. It certainly helps that they have a 34-day FREE trial period – weeks longer than most of the others I tried. You really can get familiar with the app in that amount of time and know if it will work for you.

What is YNAB?

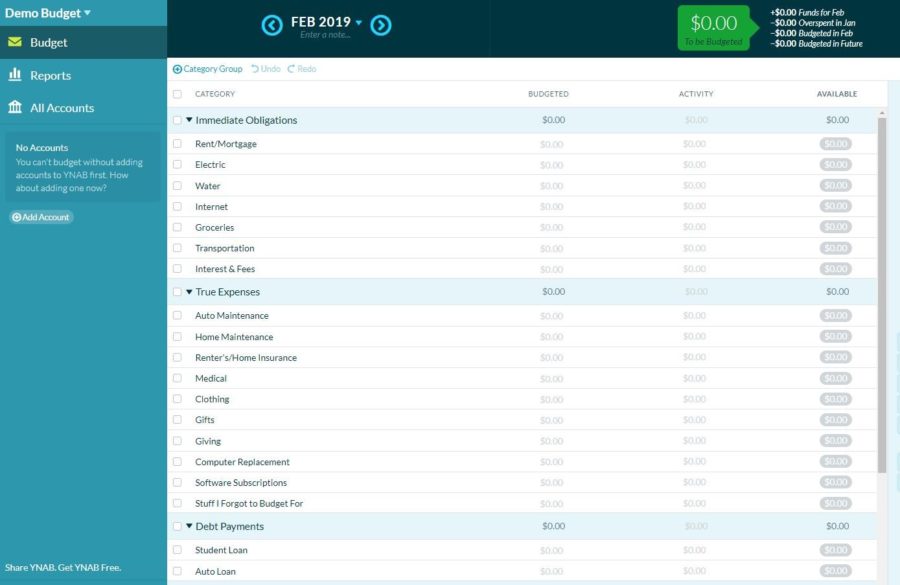

You Need a Budget (YNAB) is a budgeting app that has the unique philosophy of giving every dollar job. When you get paid, you spread your entire paycheck across categories (that you set up). Then when you go to pay for something, you enter the transaction and “withdraw” the money from the category. It is kind of like Dave Ramsey’s envelope method. The idea is, if there is no money in the category, you shouldn’t be buying what you’re buying.

There is a bit of learning curve. However, YNAB does an AMAZING job with tutorials, webinars, and help question responses – usually within 24 hours! I highly recommend checking them out for your budget.

So, you get it, I think YNAB is cool. But how does that apply to travel budgeting? Let me explain.

How YNAB Can Help You Save for Travel

Basic Overview: single income

Let’s say that you make $2000 a month and your bills are:

- Rent: $500

- Car: $250

- Student Loans: $500

- CC payments:$250

Which means I have $1000 left over after bills for everything else: groceries, pets (if you have them), coffee shop purchases, movies, you name it! Normally, you would just leave that money in your checking account and go about your month.

Well, with YNAB, you will give those dollars a job:

- Groceries: $325 (you like to cook)

- Pets: $75

- Coffee: $100 (you love your *insert yummy coffee drink here*)

- Movies: $50

Now, you have $450 left. What do you want to do with it? The goal of YNAB is to decide now. Do you want to save for future car maintenance? Stow cash away to pay for Christmas presents? Knock out some more of that credit card debt? SAVE FOR TRAVEL? The choice is 100% yours. That is the beauty of looking at your finances this way.

I know what you may be thinking. “Wow! Someone that has all that money left each month to use how they please. My life looks nothing like that.”

More Complicated: Two Incomes

Maybe this is more like your breakdown: Income: $7000

- Mortgage: $2000

- Car(s): $800

- Student Loans: $1000

- CC payments:$1500

- Groceries: $500

- Pets: $175

- Coffee: $100

- Dining out: $600

- Wine: $175

That leaves $150… not much to start a travel fund with.

Don’t be discouraged! This is your chance to make a change! Do you need to spend $100 in coffee? Can you start meal planning and cut back on expenses in the grocery category? You still have choices. YNAB allows you to see the different paths you can take to reach your end goal. It doesn’t mean that you need to start eating ramen for every meal, but maybe you don’t need to spend $150 a week eating out… and could shift some of those funds to save for travel.

Prioritize Saving for Travel

If travel is your goal, make your budget reflect that! Put money in your travel category right after you have paid your mandatory bills. We have multiple travel categories. One is for saving toward a big trip to Europe and another for smaller long weekend trips. Make sure it’s a reasonable amount, not all the money you have left over. Once you’ve set everything up and spent a month figuring out what you want your plan to look like, you can start a habit of reevaluating with each paycheck.

The other beautiful thing about YNAB, is that your not actually moving the money from account to account. It’s a tool to let you decide how to spend your money, based on your responsibilities and your goals and show you what that looks like. And your goals MAY CHANGE. When that happens, just adjust your categories, move the money into different buckets – they call it rolling with the punches at YNAB.

Slowly (or quickly) you will see your hard work pay off. It takes time and dedication, but if I can do it (any get Travis to buy in too), then I know you can do it too! Your travel dreams can become a reality since you are in the driver’s seat. And really, this tool is useful for all financial goals.

Watch Your Travel Savings Grow

YNAB has really worked for us. For us, debt is first priority, but we have decided to be less aggressive with that goal so that we can still save for travel. YNAB allows us to see how we can achieve all our goals and change our budget as we shift our goals.

Sound like it’s worth trying? It must be really expensive, right? Nope! Current pricing is $6.99/month billed annually. I personally would pay up to $15/month… that’s the value I see in the app. Sign-up here and you get a FREE 34-day trial period. Then if you subscribe after your trial, get ONE MONTH FREE.

Have you turned your finances around? Are you making amazing strides toward your goals – travel or otherwise? Tell me about them in the comments!!

Like this? Pin it!

Disclaimer: Some links in this article are affiliate links, which means that if you purchase through them, we receive a small commission. This will never cost you extra and in many cases you receive a special discount. We appreciate your support!